The conversion of Rural Enterprise Development Corporation Limited (REDCL) into a Cottage and Small Industries (CSI) bank is expected to address the issues related to high-interest rates charged by the banking institutions in the country.

The conversion of Rural Enterprise Development Corporation Limited (REDCL) into a Cottage and Small Industries (CSI) bank is expected to address the issues related to high-interest rates charged by the banking institutions in the country.

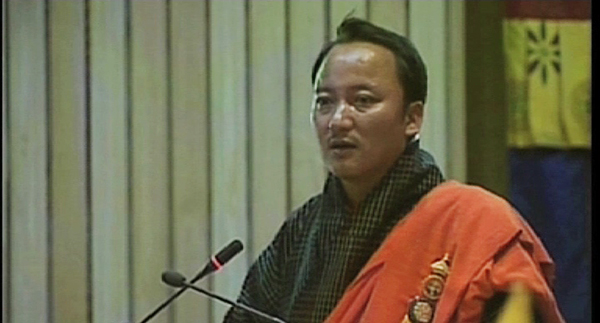

REDCL will be upgraded to a CSI bank in the coming month. The Finance Minister Namgay Tshering said the conversion will benefit people, especially the rural population, in availing loans at a minimal interest rate. It is also expected to help the development of agricultural and livestock activities in rural areas.

“We are also planning to make the loan availing process easier,” he said.

While presenting the Budget and Appropriation Bill in the National Council yesterday, the finance minister was also questioned on government’s intervention to regulate the high-interest rates charged by various banking institutions in the country.

“Banks impose high-interest rates between 8 to 12 %. And people after availing loans have difficulty in repaying the loans due to high rates. People in rural areas have also lost their lands and properties in repaying the loan,” Chhukha MP Sangay Dorji said.

“We are aware that the government is planning to upgrade REDCL to a CSI bank but then I am uncertain whether this will benefit everyone. If the government can talk with RMA and find solutions to regulate the interest rates,” Lhuentse MP Tempa Dorji said.

In response, the finance minister said the government cannot directly intervene in the matter as it would contradict the RMA Act 2010.

“As per the RMA act 2010, fiscal policy will be dealt with by the government and the monetary policy has to be managed by the RMA. Only RMA has the authority to regulate the different interest rates charged by the banks. We cannot intervene in the matter as it is not in line with the RMA act. We can only help them in policy development,” Finance Minister Namgay Tshering said.

Moreover, RMA act and policies refrain the banking institutions to minimise interest rates as it would lead to bankruptcy. The minister, however, assured the finance ministry will get in touch with the RMA and try to find solutions to regulate the various interest rates charged by the banking institutions in the country.