Druk Holding and Investments (DHI) records decline in its income last year on an account of a decrease in energy and resources segment’s total income as the Wangchhu experienced worst hydrological flows since 2008. Hydropower is the main contributor to the DHI’s income and decline in the hydropower revenue has a direct impact on the DHI’s revenue generation.

Druk Holding and Investments (DHI) records decline in its income last year on an account of a decrease in energy and resources segment’s total income as the Wangchhu experienced worst hydrological flows since 2008. Hydropower is the main contributor to the DHI’s income and decline in the hydropower revenue has a direct impact on the DHI’s revenue generation.

Druk Green Power Corporation recorded its lowest generation last year. The net export of electricity to India dropped from 5.068 million units in 2017 to 4.054 million units last year. DGPC earned Nu 11.68bn in 2018 compared to Nu 12.27bn in 2017. Hydropower contributes 85% to DHI’s annual revenue.

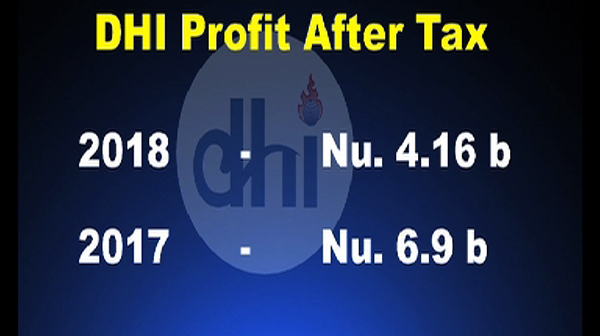

DHI’s profit after tax declined from Nu 6.9bn in 2017 to Nu 4.16bn last year. However the group last year remitted Nu 13.115bn to the Ministry of Finance which is an increase of 8.4%. Its tax payment rose to Nu 6.94bn last year from Nu 5.89bn in 2017.

Bank of Bhutan recorded its highest profit so far of over Nu 1bn. Drukair and Bhutan Telecom were also among the DHI’s top performers last year.

Dungsam Cement and Dungsam Polymers still struggled with losses. However both the companies performed better compared to past years.

DHI Chairman Dasho Ugen Chewang said that DHI has set a target to finance the entire recurrent expenditure of the government by 2030.

“Stepping to the next decade the group plans to accelerate the growth and contribute twice as much as in the first decade. For the same reason as projected by the government, the DHI group has set a destination to finance the entire recurrent expenditure for the fiscal year 2029 and 2030. Which the ministry of finance has projected at Nu 69bn,” Dasho Ugen Chewang, Chairman, DHI, said.

DHI is targeting to come out of its dependence to Hydropower for its revenue generation. DHI is on its way to upscale its revenue from the non-hydropower sources through its economic diversification. State Mining Corporation Limited and Construction Development Corporation Limited are its top priorities.