Although the Loan deferment and interest waiver since April last year has reduced the non-performing loan ratio to about 14 percent, experts say, the ratio is still too high. If it continues to remain so, it will weaken the economy. In March last year, the ratio was 19 percent. The NPL ratio measures the effectiveness of a bank in receiving repayments on its loans.

Although the Loan deferment and interest waiver since April last year has reduced the non-performing loan ratio to about 14 percent, experts say, the ratio is still too high. If it continues to remain so, it will weaken the economy. In March last year, the ratio was 19 percent. The NPL ratio measures the effectiveness of a bank in receiving repayments on its loans.

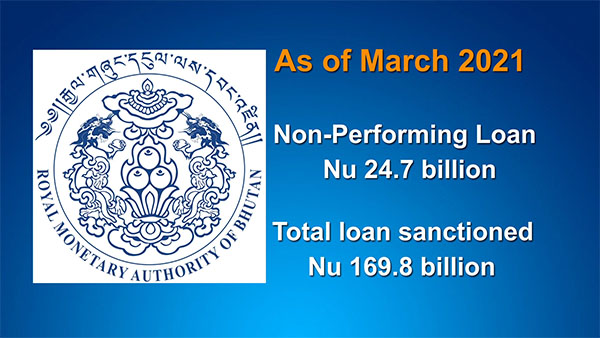

The Royal Monetary Authority’s report on financial sector performance shows that Financial Service Providers have nonperforming loans amounting to about Nu 25bn as of March this year.

The financial service providers have given out about Nu 170bn as loans. Non-performing loans are loans with payments that are overdue by 91 days or more. Some have not paid their loans for the last thirty years.

Usually, a bank should not have an NPL ratio of more than five percent. However, some of the financial institutions here have NPL ratio as high as 45 percent.

This, the financial institutions say is due to the weak loan appraisal process in banks, poor credit culture amongst borrowers and lack of accountability in various government agencies.

Karma, the President of the Financial Institutions said, “We didn’t do due diligence, we didn’t do a good job. Then the borrowers have been irresponsible and some of the agencies could have done a better job. All this has become systemic, chronic. Unless we correct this, unless the accountability of each agency of the government improves, this will continue.”

“The root cause is financial institutions not doing enough homework because when the borrowers come, they will have lots of bad quality collateral and banks may have failed to do the assessment because when banks approve the loan, you have to do a lot of assessment about the client,” said Damber S Kharka (PhD), Economist and CEO of Ugen Trading House.

The tourism and service sector has the highest non-performing loans followed by trade and commerce and production and manufacturing.

According to the Royal Monetary Authority, the Financial Service Providers in Bhutan continued to have an NPL ratio of more than 10 percent since 2018. The NPL peaked in March last year, at about Nu 28bn. Economists say if NPL continues to remain high, it will affect the GDP.

“Now the whole economy is affected because people will not get access to the loan because the bank itself will have less money. When the people or the investors do not get the loan, people won’t be able to start a good project. When they cannot start a good project, they cannot create employment opportunities. When employment is not generated, the production of goods and services is reduced and that way the whole GDP is affected,” said Damber S Kharka (PhD), the Economist/ CEO of Ugen Trading House.

The President of Financial Institutions of Bhutan, Karma added, “It’s a loss for the borrowers, for the FSPs, for the depositors and the government, for the economy, for the opportunity cost lost because now the FSPs don’t have enough money, enough liquidity. If the money has not come back, somebody has a beautiful investment opportunity, if the country is going to gain out of it and we are going to export it, we don’t have the money to fund that. It’s all linked in the macroeconomy.”

The government and the central bank have now developed a National NPL resolution strategy. The banks try to recover the NPL through foreclosure or write off, transfer of nonperforming loan assets and segregation of NPL into viable and non-viable loans.

“We are looking at two sets, viable, where we sit together and plan to rehabilitate the project, and non-viable, there is no point for waiting. To resolve all this, RMA has given us three years. Since you mentioned that RICBL has the highest NPL, we have been resolving this for the past three years. Yes, we were not perfect with our methodology, from this year we have a dedicated team only resolving NPL, speaking to the borrowers and discussing with the borrowers,” said Karma, the President of Financial Institutions of Bhutan.

Non-performing loans might reduce and avoid the burden on the country’s economy. But that might take quite a while.

Sangay Chezom

Edited by Tandin Phuntsho