The discontinuation of Royal Insurance Corporation of Bhutan’s Drukyul Life Insurance Plan, launched in September 2023 has left thousands of policyholders frustrated over the lack of communication and transparency. The scheme was suspended as of April 25, last year. It is a one-year term renewable life insurance plan, similar to Rural Life Insurance but with a few key differences.

The discontinuation of Royal Insurance Corporation of Bhutan’s Drukyul Life Insurance Plan, launched in September 2023 has left thousands of policyholders frustrated over the lack of communication and transparency. The scheme was suspended as of April 25, last year. It is a one-year term renewable life insurance plan, similar to Rural Life Insurance but with a few key differences.

RICB introduced this plan in response to concerns shared by the public that a rural life insurance payout of Nu 30,000 in the event of death is insufficient.

RICB introduced this plan in response to concerns shared by the public that a rural life insurance payout of Nu 30,000 in the event of death is insufficient.

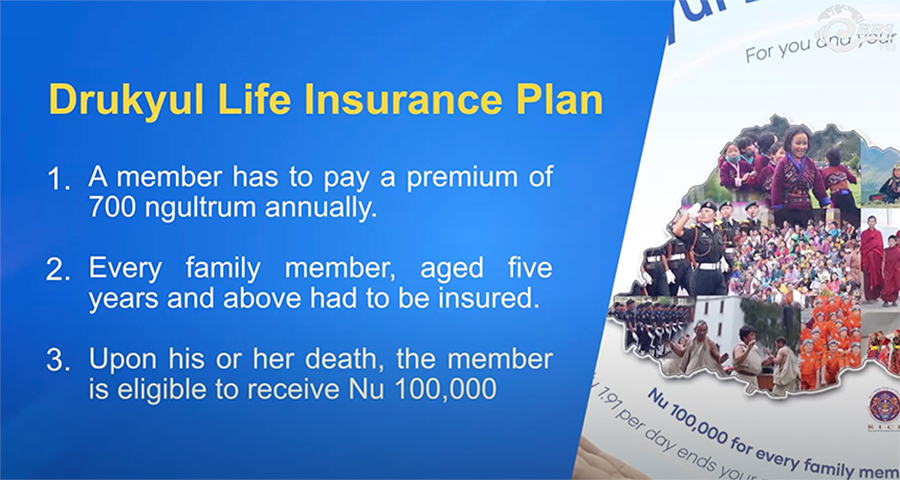

Under the policy, a member has to pay a premium of Nu 700 annually. And every family member, aged five years and above had to be insured. The member is eligible to receive Nu 100,000 upon his or her death within the policy period.

Since its inception, over 17,700 members have enrolled in the scheme.

According to RICB, a total of 379 claims were made under the policy since its launch and the high number of payouts led to financial concerns.

Despite collecting over Nu 12 M in premiums since its launch, RICB has paid out nearly Nu 38 M in death claims.

This financial imbalance made the policy unsustainable for the company, leading to its suspension after just seven months.

RICBL’s CEO Karma said, “Our data shows that 2,451 policies are still active, which means we will compensate those members. The claim that RICB is not refunding money is incorrect. The policy was for one year, and if you don’t have an active policy, compensation cannot be made. It was clearly stated when the policy was issued that it would last for one year. Regardless of whether RICB has sufficient funds, we are obligated to pay the compensation within that period.”

However, policyholders argue that they were not notified when RICB decided to suspend the plan. They said that their premiums should be refunded.

Given that the policy was intended for a valuable purpose, many have expressed frustration over its abrupt suspension.

They also said RICB failed to market the product well.

“Suspending the product midway without prior notice is misleading. At the very least, clients should have been informed in advance. If no claims were made, a partial refund should have been offered. As clients, we deserve transparency. If they had communicated their inability to continue, we would have understood,” said Jamtsho, a former policyholder.

“If we had been informed that the policy was only valid for a year, many people would not have signed up. I understand that this policy works like vehicle insurance, but it lacks continuity. Why has it been discontinued? An insurance company is meant to take risks – that’s its core purpose. Life insurance shouldn’t operate on a model where companies only continue when profitable and stop when they face losses,” said Loday Gyeltshen, a former policyholder.

“I feel as though this policy was treated like a pilot programme with no proper planning. It seems we were misled. When I was about to renew my plan, I was told it had been suspended. I’m not alone in feeling this way – my friends share the same concerns. If they decide to suspend the policy, they should at least offer a refund. Even if not the full amount, a partial refund would be fair,” said Tobdhen Wangchuk, a former policyholder.

Moreover, many also took to social media to voice their discontent labelling the policy a scam. They also criticised RICB’s move as a critical service being withdrawn without warning.

Meanwhile, RICB revealed that for every single claim of Nu 100,000 for the plan, it needed contributions from 143 policyholders. So to revive this policy, the company’s CEO said it will need more people to participate.

However, those who enrolled in the plan before its suspension, remain covered until April 24th of this year.

Samten Dolkar

Edited by Kipchu