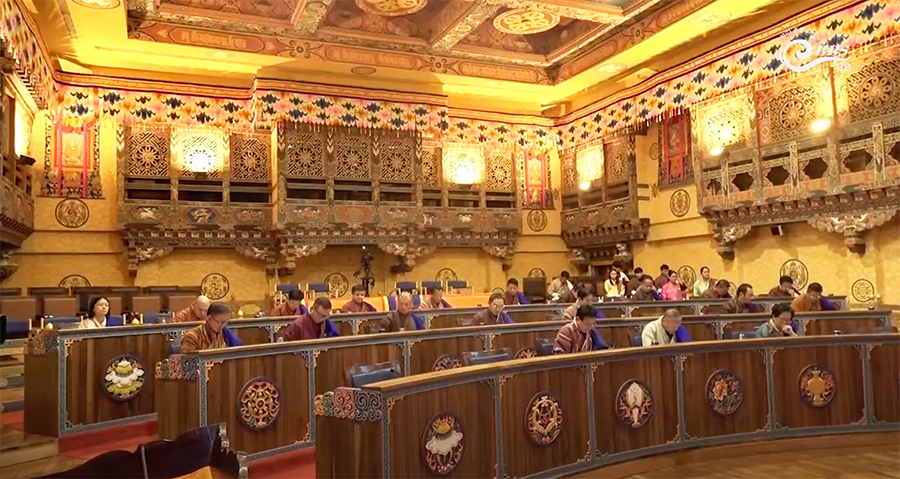

Make educational loans more accessible for young people from low-income families. This is what council members discussed today while deliberating about rural credit access. Rural credit plays an important role in addressing the financial needs of rural populations. Though the rural credit scheme was established in the early 1980s, accessing it remains a challenge for the rural populace even after four decades.

The Economic Affairs Committee suggested banks could lower the interest rate of education loans and increase the repayment period. They also said the repayment could also start only after gainful employment.

Though members support the recommendation, a few raised concerns regarding the eligibility criteria to get an education loan.

The education loan requires parents with a reliable income and a mortgage, which does not favour young people or orphans from humble backgrounds.

“”They lack a guarantor, as they do not have parents and own no land in urban areas—only wetlands in rural regions. Therefore, even when the government provides opportunities, they are unable to take advantage of them,” said Tashi Dendup, MP, Samtse, National Council.

“The recommendation on streamlining documents includes simplifying documents to apply for loans. Does this mean that they do not have to provide mortgage and have a reliable source of income?” questioned Pema Tashi, MP, Sarpang, National Council.

Some members said the criteria need to be more inclusive. Committee member Sonam Tenzin said the recommendation on offering concessions for education loans considers all these issues. The recommendation says to implement policies to provide subsidies for educational loans, particularly for students from low-income families to promote access to education.

Besides the education loan, the House deliberated about 10 more recommendations. The members discussed challenges faced by the rural population while accessing loans such as financial literacy, documentation processes, loan ceiling and interest rate among others.

The House will adopt the recommendations next week.

Singye Dema

Edited by Tandin Phuntsho