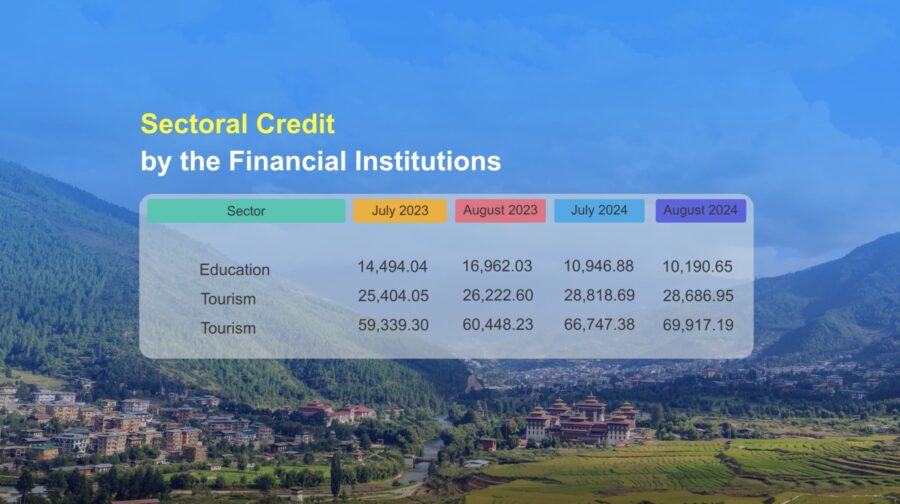

Going by the Central Bank’s monthly statistical report, the number of Bhutanese seeking education loans is decreasing. According to the Royal Monetary Authority, education loan applications dropped by more than 40 per cent over the past year. Total credit for the sector fell from around Nu 17bn to Nu 10bn.

From processing about 50 education loans daily and disbursing up to Nu 4.5bn each quarter at one point in time, financial institutions say they now only process one education loan per day on average.

According to the banks, this decline could largely be due to reduced demand for education loans. An education loan, required to meet the financial eligibility criteria for student visas, is used to demonstrate sufficient funds to cover tuition and living expenses abroad.

In addition, IELTS centres in the country witnessed a decrease in the number of registrations. According to IELTS centres in Thimphu, from conducting the English Language proficiency test twice a month last year, they now conduct the exam only once a month.

Education consultancies have also reported a decline in the number of applicants this year. From receiving up to 15 applicants daily last year, they are now seeing the same number of applicants only once a week.

Meanwhile, lending in other sectors in the country continues to grow. Housing loans, for instance, have surged to around Nu 70bn. Similarly, loans in the tourism sector have reached almost Nu 30bn.

Most of the institutes and the organizations BBS spoke to say the decline in education loans could be attributed to Australia’s revised migration strategy, particularly the stricter English-language requirements and the crackdown on low-cost colleges.

BBS has yet to receive the latest official figure on the number of Bhutanese citizens who have opted to study abroad from the Ministry of Foreign Affairs and External Trade.

Karma Samten Wangda

Edited by Phub Gyem