The National Assembly agreed to set the Goods and Services Tax (GST) registration turnover threshold at Nu 5 M per annum. This means a business entity will be liable to pay GST only if their annual sales turnover exceeds Nu 5 M.

The National Assembly agreed to set the Goods and Services Tax (GST) registration turnover threshold at Nu 5 M per annum. This means a business entity will be liable to pay GST only if their annual sales turnover exceeds Nu 5 M.

This was discussed during the third reading of the Goods and Services Tax (GST) Bill of Bhutan 2020 yesterday.

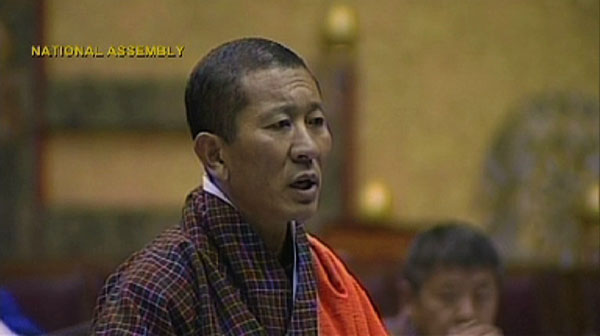

Only about 1800 registered businesses have annual sales turnover of over Nu 5 M. Member of Parliament from Panbang Dorji Wangdi recommended reducing the threshold to Nu 3 M but the majority of the members did not support him.

Sangay Chezom