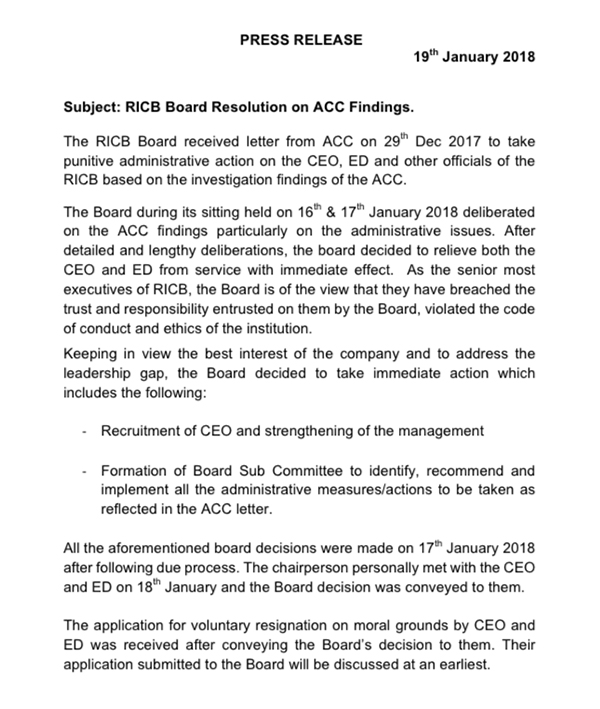

The board of the Royal Insurance Corporation of Bhutan relieved its Chief Executive Officer (CEO) and Executive Director (ED) from service. This decision, according to the board, is following the Anti-corruption Commission (ACC)’s directive to take disciplinary action on the two executives and other officials of the company based on the Commission’s investigation findings.

A press release issued today states that following a two-day meeting, the board, on Wednesday, decided to relieve the two executive heads. It states that they have breached the trust and responsibility entrusted on them by the board, violated the code of conduct, and ethics of the institution.

Further, in the interest of the company the board will recruit a new CEO and strengthen the management of the company. It will also form a Board Sub Committee to identify, recommend and implement all the administrative actions to be taken as reflected in the letter issued by ACC.

The two executives submitted voluntary resignation letters to the board’s chairman yesterday. But the news release states that the chairman received the resignation letter only after conveying the board’s decision to them. The executive director, over a telephone interview yesterday, said their resignation is in the interest of protecting the company’s reputation and 17 other employees, who were also being charged. “We have been picking from the mainstream media which often highlighted the issue and reported 17 employees were charged. All the operational allegations happened during our tenure”.

Taking this into consideration, the Executive Director said the CEO and himself have taken the moral responsibility to resign. “It has been six months that RICBL is without executives, without leader. In such a big company with over 17 or 18 billion worth of assets, things cannot function like this for long. Therefore, to bring everything under logical conclusion, we took this step.”

The two executives were accused of irrational investment in Nubri Capital, a private fund management company. It is alleged that RICBL had invested Nu 100 M in Nubri Capital at lower interest rate and later borrowed money from the same company at a higher interest rate. The ACC also charged them of seven other allegations, mostly, administrative lapses.