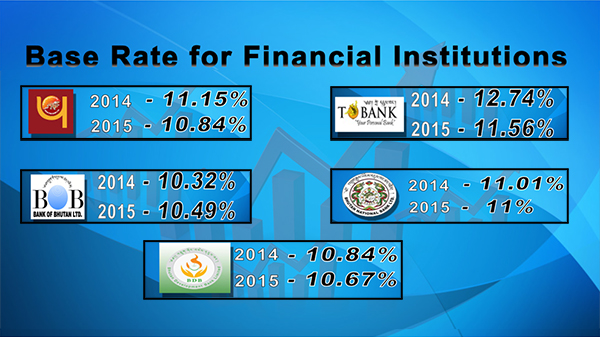

The minimum-lending rate, called the base rate for most financial institutions, has decreased this year, compared to last. Base rate is the minimum lending rate below which banks are not permitted to lend.

The minimum-lending rate, called the base rate for most financial institutions, has decreased this year, compared to last. Base rate is the minimum lending rate below which banks are not permitted to lend.

Base rate is calculated on how much cost a bank incurs on its deposit in the form of interest payments to depositors. The rate is calculated annually by individual banks and is submitted to the Royal Monetary Authority for approval.

Save for Bank of Bhutan, the base rate for all the banks has decreased.

A banker said, when a base rate decreases, banks are in a better position to lower their interest rates on loans and thus expand their business. Despite marginal increase in its base rate, the Bank of Bhutan has lowered its interest rates on various loan products.

Other banks are likely to revise their interest rates since their cost of fund has decreased. A reduction in base rate meant, reduced cost of fund, thereby allowing more room for bankers to reduce their interest rate on loans, the Druk PNB’s Chief Executive, Mukesh Dave said.

However, to revise their interest rates, banks would also have to take account of their non-performing loans, if incidences of non repayment of loans are higher in a bank, banks will not reduce their interest rates, Mukesh Dave said.

But, it is not clear weather borrowers would be charged the new interest rate or the existing interest rate if they already had borrowings from a bank.

Bankers said the base rate had come down this year, since many banks were cautious when it came to accepting large deposits. Banks were not interested to accept deposits since they were already flooded with cash. This ultimately resulted in lower cost of fund.

For non-bank financial institutions like insurance companies and pension funds, base rate is determined by the central bank.