The number of people investing in stocks and shares in Bhutan is growing. But what is also growing with this is the number of unclaimed dividends. Starting from 1993 to date, unclaimed dividends worth almost Nu 80 M from Bhutan’s 16 stock exchange companies are still lying with the companies. An unclaimed dividend is recorded when a shareholder fails to claim an already paid dividend.

Unlike stock markets elsewhere in the world, the stock market in the country is visibly calm. The Royal Securities Exchange of Bhutan, the only stock market in the country has a huge number of unclaimed dividends. According to the RSEB, it is due to the investor’s lack of responsibility to update their information including CID numbers and bank account numbers reflecting poor financial literacy and personal finances among Bhutanese.

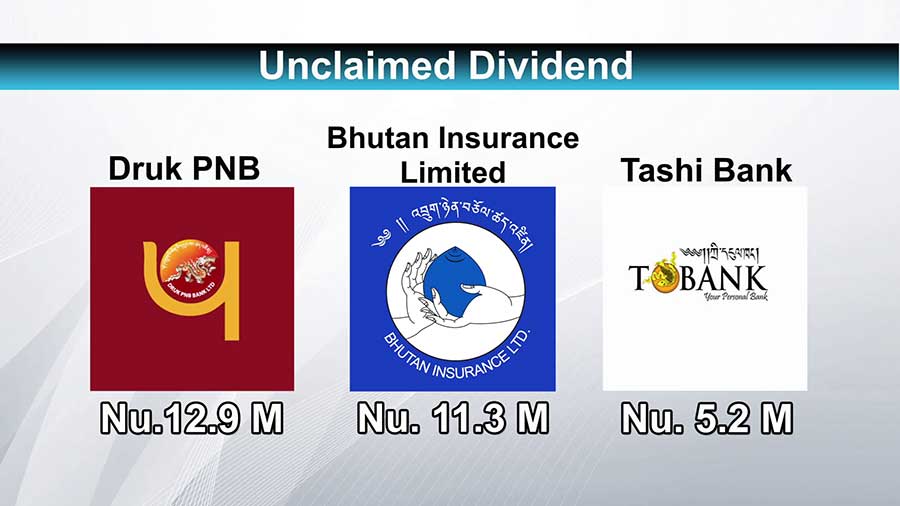

Today, there are 19 listed companies with the RSEB. Of the 19, 16 companies have recorded unclaimed dividends of almost Nu 80 M. Druk Punjab National Bank has recorded the highest unclaimed dividends of more than Nu 12 M followed by Bhutan Insurance Limited and Tashi Bank.

Today, there are 19 listed companies with the RSEB. Of the 19, 16 companies have recorded unclaimed dividends of almost Nu 80 M. Druk Punjab National Bank has recorded the highest unclaimed dividends of more than Nu 12 M followed by Bhutan Insurance Limited and Tashi Bank.

“Technically, prior to 2016, our data were a little loose, in the sense we were not able to get the right data because our stock exchange started in 1993. So by then, everything was kept in excel. So the depository records were also not maintained well against all required fields,” said Dorji Phuntsho, the CEO of the RSEB.

It became more difficult when the country issued new citizenship identity cards somewhere in early 2000.

“So the records previously pinned by the old identity card numbers are no longer relevant as well as useful for us. So we have such records where the share owners are still reflected in the old identity cards,” he said.

Shares also become unclaimed for reasons such as heirs being unaware of their inheritance and share certificates being misplaced or lost.

However, the RSEB says every person, who has come to the capital market and invested money, is eligible for dividends as and when due. The office said there is no law specifying the expiry of such funds as long as the person can prove his ownership of the investment, as of now.

The RSEB is also in talks with the regulatory authorities to establish Investor Protection Fund where all the unclaimed dividends will be saved there rather than with the company. However, there is no legal framework to address the issues as of now.

“The unclaimed funds are kept with the company right now. And they cannot use them because it belongs to investors. Unlike other countries where the legal framework is very strong, many countries have something called an investor protection fund where all unclaimed funds are kept or bundled up into that fund. And it’s made into investments. They cannot touch the principle amount but income from that fund is used in financial literacy programmes as well as to reach out to those investors who are not aware that they have unclaimed funds with the companies,” he added.

While the unclaimed dividends of about Nu 80 M are not much of a concern given the worth of the stock market valued at Nu 52bn, the RSEB says it is not fair to the investors who are also a part of the company from where they bought the shares.

Samten Dolkar

Edited by Sonam