The total amount of non-performing loans or bad loans in the commercial banks has increased from Nu 3B in 2010 to Nu 7.6B last year. In other words 12 percent of total credit dished out by the financial sector has defaulted.

The total amount of non-performing loans or bad loans in the commercial banks has increased from Nu 3B in 2010 to Nu 7.6B last year. In other words 12 percent of total credit dished out by the financial sector has defaulted.

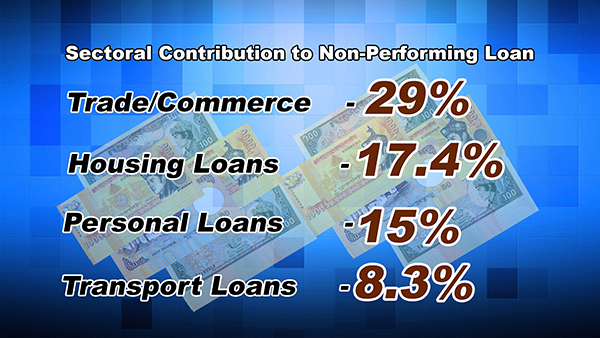

According to the RMA Annual Report, which was published recently, trade and commerce, which mostly includes activities such as mining, retail, imports and exports, recorded the highest default at 29 percent followed by housing and personal loans.

A loan becomes non-performing when repayment has not been made for three months or ninety days.

Local economists said the restrictions that were imposed since 2012 had contributed to the rise in loan defaults as economic activity slumped affecting people’s repayment.