It is the time of the year when companies listed under the Royal Securities Exchange of Bhutan declare dividends and bonuses. The news of companies declaring dividends and bonuses have stirred up investor confidence leading to high trade volume and rising stock prices in March.

In a five-day period when markets were open, last week, the total market capitalisation of the 18 listed companies in the Royal Securities Exchange increased by Nu 2bn to 66bn.

The total market capitalisation is the combined value of all the companies’ stocks that trade on the stock exchange.

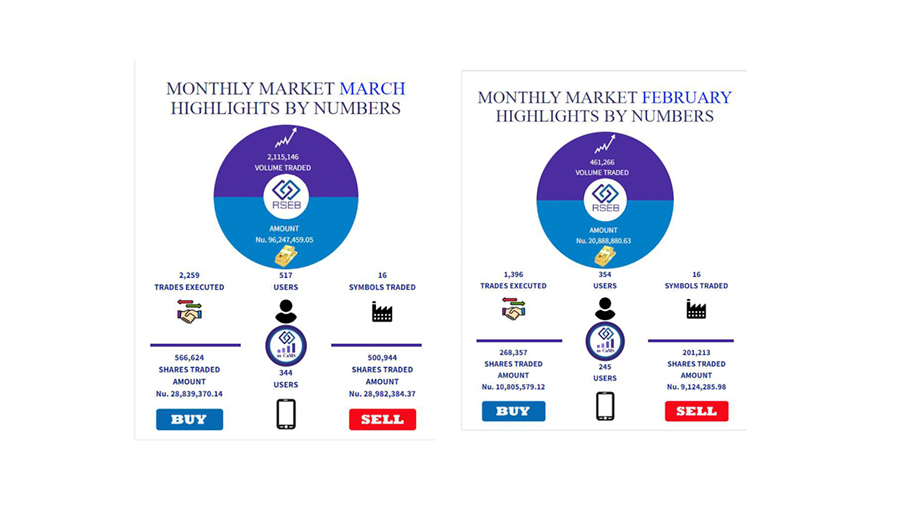

The monthly market highlight between February and March of this year reveals significant shifts.

In February, over 460,000 volume of shares, worth more than Nu 20 M, were traded.

On the contrary, the volume of shares traded in March grew by almost fivefold to over two million. Almost Nu 100 M worth of shares were traded in March.

As for dividends and bonuses, the State Trading Corporation of Bhutan Limited announced a bonus for its shareholders, giving one bonus share for every two held. The record date for this bonus is set for tomorrow.

The record date is the cut-off date for determining which shareholders are entitled to receive a dividend payment or bonuses.

Similarly, the Bhutan Ferro Alloys Limited or BFAL declared 100 per cent dividend for its shareholders.

For instance, if a BFAL shareholder has 5,000 shares then at the face value of Nu 10 a share, the individual will receive Nu 50,000 as dividend payment. The company has yet to set its record date.

Meanwhile, the Bhutan Insurance Limited (BIL) has proposed a 21 per cent dividend, pending approval from the Royal Monetary Authority. An individual with 5000 BIL shares will receive 10,500 as dividend payment.

Likewise, the Bhutan National Bank proposed a 15.4 per cent dividend, potentially resulting in a Nu 7,700 pay out for shareholders with 5000 shares. This is also subject to approval from the central bank.

GIC Bhutan Reinsurance Corporation Limited, another company on the stock market, proposed a 10 per cent dividend. The company will hold its annual general meeting, tomorrow, and take the proposed dividend to the central bank for approval.

The Druk PNB Bank Limited proposed a 15 per cent dividend for 2023 and are awaiting endorsement from the central bank.

However, shareholders of Dungsam Polymers Limited, Bhutan Carbide and Chemicals Limited, and Bhutan Board Products Limited will go empty handed.

These companies had no corporate actions, resulting in no rewards or benefits for the shareholders.

As companies declare dividends, the Royal Securities Exchange of Bhutan is urging shareholders to update their bank account numbers with the central depository of the stock exchange to avoid unclaimed dividends, which could pose liabilities for the companies.

The remaining companies must convene their annual general meetings by the end of April in compliance with the Companies Act of Bhutan, 2016.

Samten Dolkar

Edited by Sherub Dorji