The freeze on construction loans and ban on import of cars, besides other restrictive fiscal and monetary measures, did not only suppress economic growth, but also affected government’s revenue collection.

The freeze on construction loans and ban on import of cars, besides other restrictive fiscal and monetary measures, did not only suppress economic growth, but also affected government’s revenue collection.

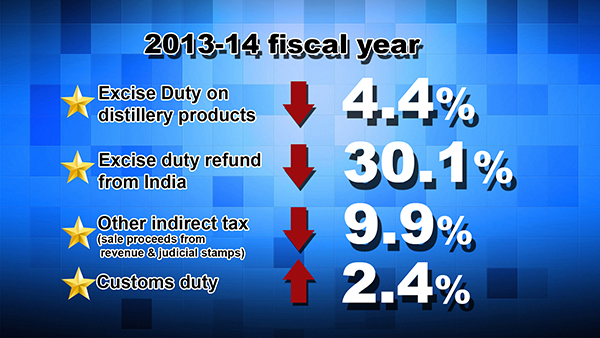

The decrease in government’s revenue was felt mainly in terms of indirect tax collection, which decreased significantly by 16 percent compared to previous year. This was a direct result of the several macroeconomic measures put in place post 2012 rupee crisis.

In absolute terms, indirect tax decreased by almost Nu.1 B from Nu.6 B to Nu.5 B.

Indirect tax constitutes sales tax, excise duty, customs duty and green tax, which are mostly taxes imposed on import of commodities. The ban on import of cars and freeze on construction loans had significant bearing on indirect tax collection.

Usually, an increase in the level of indirect tax indicates increased consumption. Pre-2012, before the restrictions were imposed, consumption, both private and public had reached unprecedented level. Consequently, indirect taxes also increased by a huge 60 percent in the 2011 and 2012 fiscal.

However, direct tax collection increased 18 percent between 2013 and 14.

Under direct tax, Corporate Income Tax (CIT) increased by 26 percent. The Druk Green Power Corporation was the top contributor of CIT followed by Druk Holding and Investments and Bhutan Power Corporation.

Total revenue, both tax and non tax, collected in the fiscal year 2013-14 amounted to Nu. 23 B.

Domestic revenue was able to cover 100 percent recurrent expenditure as well as 32 percent capital expenditure. The constitution of Bhutan mandates all recurrent expenses to be covered by domestic revenue.