The Bhutan Integrated Taxation System, worth over a billion ngultrum, will be accessible to taxpayers by next month. According to the Department of Revenue and Customs, the system is on track for launch and will soon serve as the primary portal for filing taxes.

The Bhutan Integrated Taxation System, worth over a billion ngultrum, will be accessible to taxpayers by next month. According to the Department of Revenue and Customs, the system is on track for launch and will soon serve as the primary portal for filing taxes.

The new Goods and Services Tax, Income Tax, and Excise Tax will come into effect from January next year. However, for now, only the Goods and Services Tax and Excise Tax will be implemented through the Bhutan Integrated Taxation System, or BITs.

The new Goods and Services Tax, Income Tax, and Excise Tax will come into effect from January next year. However, for now, only the Goods and Services Tax and Excise Tax will be implemented through the Bhutan Integrated Taxation System, or BITs.

Around 3,500 businesses with an annual turnover of five million ngultrum or more will be required to register under the GST framework.

“If you are not registered, you will have to pay GST on any goods purchased from outside at the point of entry. However, since you are not registered, you will not be able to collect GST or claim the benefit of Input Tax Credit,” said Sonam Jamtsho, the Director General of the Department of Revenue and Customs.

The updated Excise Tax will require brand registration of alcoholic beverages through eCMS and use BITs to file their returns and track their imports and sales.

The department clarified that brand registration does not grant commercial exclusivity but serves as a regulatory control measure to ensure accountability and transparency.

Yeshey Seldon, a collector with the Customs and Excise Division said, “Brand registration fees will apply to both domestic and imported products. Although registration has not yet started, we already have a list of registered products from the existing system. The fee is set at 100,000 ngultrum per brand per dealer for imported liquors, and 35,000 ngultrum for domestic liquors.”

The Excise Tax apply to tobacco, alcohol, carbonated drinks, supari, pan masala, and vehicles

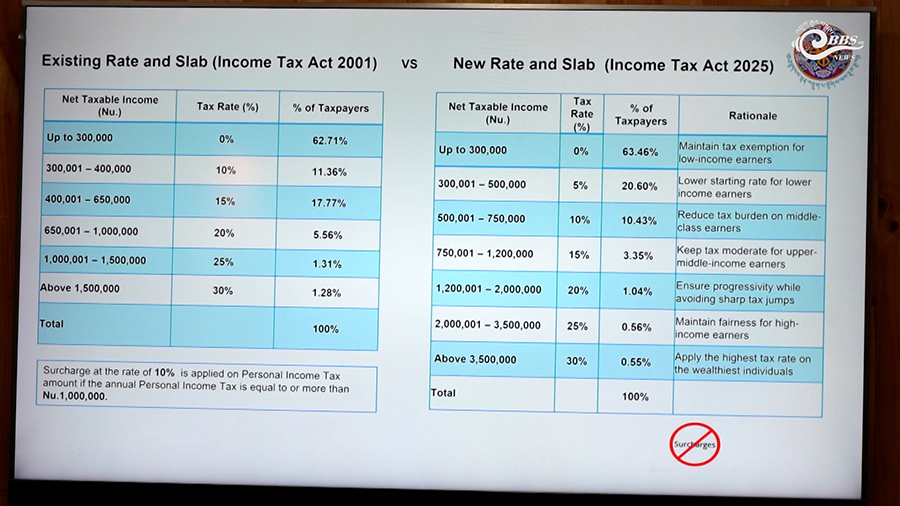

Meanwhile, the Income Tax Act 2025 will be integrated into BITs starting from 2027. This year, individuals must continue to file their Personal Income Tax returns through the RAMIS system.

“In 2026, when individuals file their taxes, they will have to declare their business income together with their personal income. The Act also introduces a 10 per cent final withholding tax on interest income and dividend income, with exemptions for Nu 300,000 for dividend income and Nu 400,000 for interest income,” said Tashi Wangmo, a collector, with the Income Tax Division.

The Act provides several tax reliefs for resident individuals, including those related to education expenses, homeownership, insurance, disability, donations, health contributions, and the Parenthood Tax Child Credit.

To prepare for the implementation of the new tax regimes, the Department has trained its officials, end users, and business entities. It has also upgraded computer systems across regional offices and conducted network assessments to ensure smooth and efficient operations.

Additionally, the Department continues to carry out awareness and outreach programmes for both officials and business owners.

The new Goods and Services Tax, Income Tax, and Excise Tax regimes were introduced to simplify and modernise Bhutan’s tax system. Parliament endorsed the legislation during its last session.

Kinzang Lhadon & Namgay Dema & Kinley Bidha