The Royal Securities Exchange of Bhutan, RSEBL, is seeing increased stock market participation. The stock market recorded more than 25,000 transactions last year. This means investors have bought and sold stocks more than 25,000 times. It is a 30 per cent rise compared to 2023. The surge is attributed to improved accessibility to the stock exchange market through the m-CaMS app and ongoing efforts to promote financial literacy.

The Royal Securities Exchange of Bhutan, RSEBL, is seeing increased stock market participation. The stock market recorded more than 25,000 transactions last year. This means investors have bought and sold stocks more than 25,000 times. It is a 30 per cent rise compared to 2023. The surge is attributed to improved accessibility to the stock exchange market through the m-CaMS app and ongoing efforts to promote financial literacy.

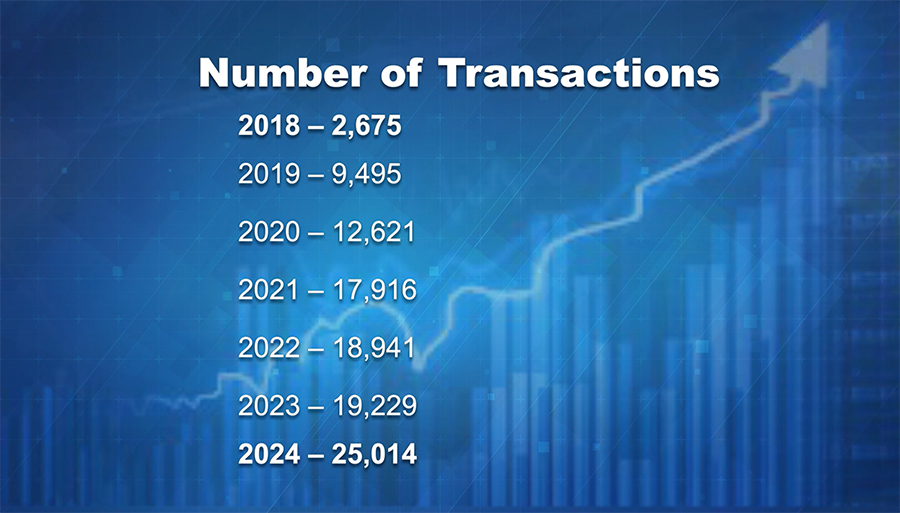

Since the introduction of the m-CaMS app in 2018, stock trading activities have steadily increased.

The stock market recorded just 2,675 transactions in 2018 and by 2024, the number has surged to more than 25,014.

The stock market recorded just 2,675 transactions in 2018 and by 2024, the number has surged to more than 25,014.

“The increase can be attributed to the m-CaMS app, which has made trading more accessible. With over 5,000 active m-CaMS subscribers, the market has seen transactions worth approximately Nu 400 M. Mobile trading has made the process much more convenient,” said Dorji Phuntsho, RSEBL’s CEO.

Traditionally, investors had to contact brokers directly to make trades. Currently, there are nine brokers and 18 companies listed under RSEBL.

Today, online traders, including Bhutanese living abroad, are using the app to buy and sell shares. Most of them engage in frequent but small transactions.

The RSEBL reported that about 16 million shares were traded last year, a slight decrease from 2023.

The CEO said, “The decrease in volume isn’t a concern. Even a single investor making a large transaction can significantly impact the market. What’s important is the rising number of participants. For example, the number of transactions has jumped from 19,000 to 25,000, a 30 per cent increase, showing more people are actively engaging in the market.”

To further enhance flexibility and modernise the country’s capital market, RSEBL plans to launch two key initiatives this year: margin trading and continuous trading.

Margin trading will allow investors to borrow funds from brokers to purchase additional shares. Continuous trading will enable uninterrupted transactions throughout the trading day.

Currently, the stock market operates under a fixed trading system, where transactions occur during a specific time, and prices are fixed at the start of trading sessions.

Kinley Bidha

Edited by Sangay Chezom