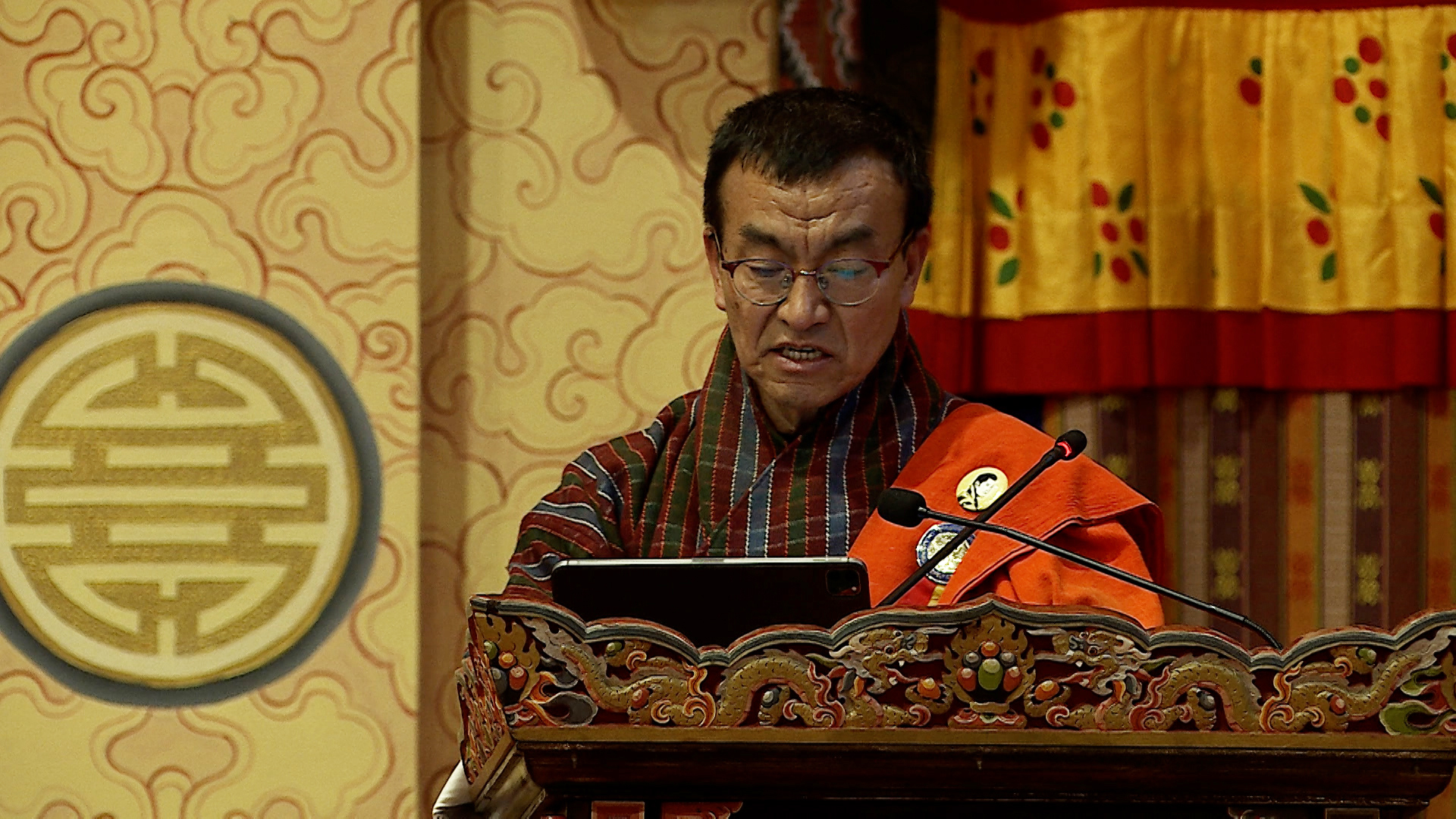

The government will collaborate with the RMA and other stakeholders to enhance transparency and accountability and reduce fraud risks in the financial sector. Finance Minister Lekey Dorji said this while responding to questions during the National Council’s question hour session today. Monggar MP Tshering Wangchen questioned the minister on accountability in financial institutions, measures to strengthen monitoring systems, strategies to combat digital fraud, and efforts to promote transparency and accountability in the sector.

The minister shared that the RMA collaborates with international organisations, focusing on training, adopting global best practices, and improving internal controls. He also talked about key measures to strengthen accountability in Bhutan’s financial sector.

“The RMA has clear rules on accountability. RMA’s Rules and Regulations for Accountability of Key Responsible Persons of Regulated Entities 2022, ensures identification of key people in financial institutions to take responsibility.”

In response to rising digital fraud, the minister said that the RMA has implemented 15 digital control measures and network security protocols.

He said that these include cyber security awareness, ensuring data resilience through regular backups, and information security policies, among others.

“The RMA also has plans to form an Information Security Steering Committee to oversee Cyber security governance. Moreover, they will also appoint an Information Security Officer in every financial institution.”

The finance minister added that the information security officer in every financial institution will manage and respond to security incidents and data breaches. This includes investigating the causes, mitigating the damage, and implementing measures to prevent future incidents.

Phub Dorji, Sangay Chozom & Karma Samten Wangda

Edited by Sonam Pem