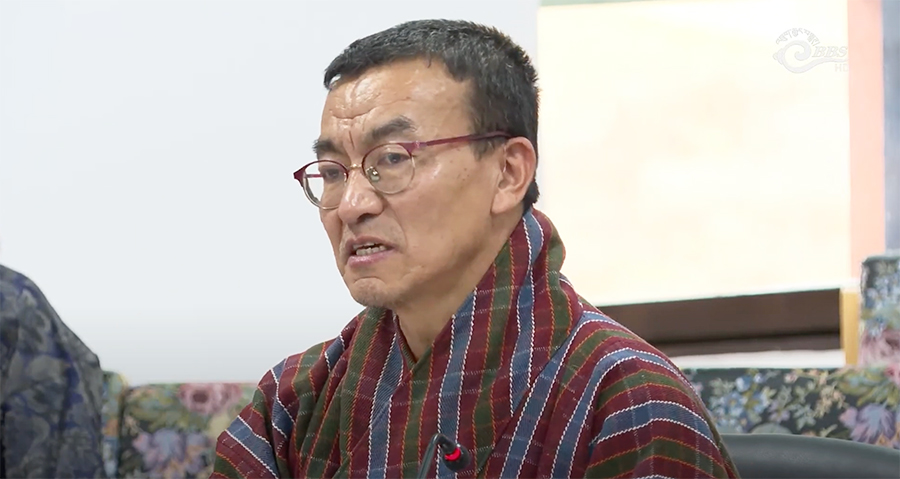

The Ministry of Finance is targeting July 2025 for the implementation of the Goods and Services Tax (GST) though a final date has yet to be decided. The finance minister revealed this during the Meet the Press session.

The GST was introduced as a reform to modernise and simplify Bhutan’s tax system, aiming to create a more streamlined process for businesses and consumers.

Initially scheduled for implementation in July 2022, the GST has faced multiple delays. Additionally, the National Assembly withdrew the GST (Amendment) Bill from the ongoing parliament session, further postponing its implementation.

The finance minister explained that the GST (Amendment) Bill was withdrawn due to challenges with the Bhutan Integrated Taxation System and the government’s focus on economic recovery from the COVID-19 pandemic.

Lekey Dorji, Finance Minister said “The business units with the annual turnover of Nu 5 M based on the 2023 fiscal year will be automatically registered for the GST. However, other business units that had the turnover of not less than Nu 2.5 million in the last one year can opt for a voluntary registration.”

Additionally, the finance minister said that vehicle taxes are set to see a decrease with the implementation of GST.

“When we introduce GST sometime next year, we hope that (vehicle) prices might come down because it depends on how taxes are levied. It is based on the point of entry and the point of sale. So, if taxes are applied at the point of entry, prices are likely to decrease. Therefore, I believe this is good news.”

Meanwhile, the Department of Revenue and Customs will conduct awareness programmes and training for its officials as the implementing agency. Outreach programmes will also be given to business owners for the implementation of GST.

Kinzang Lhadon

Edited by Kipchu