Taking into account the loss of revenue in the small and micro businesses, especially in the rural areas amid the pandemic, the Finance Ministry extended the exemption of Business Income Tax for such businesses until 31st December 2024. The Department of Revenue and Customs issued a notification today.

Taking into account the loss of revenue in the small and micro businesses, especially in the rural areas amid the pandemic, the Finance Ministry extended the exemption of Business Income Tax for such businesses until 31st December 2024. The Department of Revenue and Customs issued a notification today.

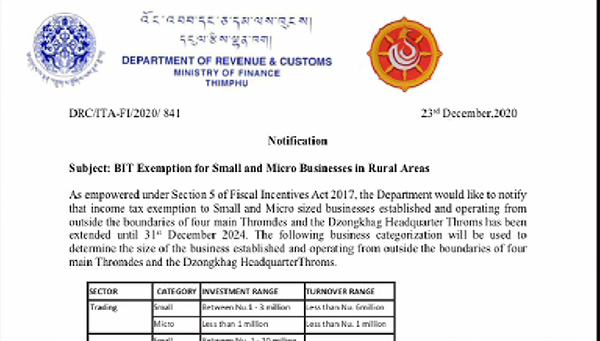

According to the notification, the exemption applies to only small and micro-businesses that are established outside the four thromdes and dzongkhag throms. And such businesses according to Finance Minister Namgay Tshering include mostly general and grocery shops which have an investment value of up to Nu 3 M.

”This initiative will narrow the gap between rich and poor, and also encourage business in the rural areas,’’ said the minister.

The minister further added that the government has so far exempted over Nu 32 M because of the exemption. This has benefitted over 12,000 small and micro-businesses across the country in 2019, according to the minister. Such businesses as per the minister have also generated employment opportunities and provided services in the country.

The registered micro license holders and small business entities must file their tax returns using the Department of Revenue and Custom’s BIT Estimated Tax App (BETA) for the record. The Department of Revenue and Customs will soon launch an App that will issue an online tax clearance certificate to the exempted entities.

The minister further added that entities outside of the identified business won’t have to pay tax if there was no income.

Meanwhile, businesses such as tour operators, ticketing agents, construction, and logging businesses will not be eligible for the exemption.

Kinley Dem