Besides the recommendations made by the World Bank to improve the financial sector, Bhutan’s stock exchange, the Royal Securities Exchange of Bhutan Ltd (RSEBL) is calling for reforms from within the economy.

Besides the recommendations made by the World Bank to improve the financial sector, Bhutan’s stock exchange, the Royal Securities Exchange of Bhutan Ltd (RSEBL) is calling for reforms from within the economy.

Of the total 108 recommendations, the World Bank’s financial sector development action plan also asks the government to increase the supply of debt and equity instruments to pick up slack in the capital market.

The action plan recommends the government to float shares of at least two of its state-owned-enterprises.

RSEBL’s Chief Executive Officer, Dorji Phuntsho said the government need not necessarily float shares of its profitable companies.

“Ideally, if the move is to deepen the capital market and make it more vibrant, then as the report suggests, the government can opt to divest shares of its state-owned-enterprises. But at the same time, since ours is a welfare oriented society, we have to consider at what cost it will come through, whether it will benefit only a few individuals or the economy at large.”

Earlier, in one of the meet the press session, cabinet ministers said floating government shares can reduce government revenue and thereby impact priority programs like providing health and education.

However, Dorji Phuntsho said, rather than floating government shares, private companies can be listed in the exchange.

“To make the capital market more vibrant, there are other options, which unfortunately the report didn’t cover. The government through various incentives can attract private companies to list in the stock exchange. This will bring about improvements in the form of corporate governance, auditing and accounting, which will ultimately lead to efficiency. Studies have also proven that through such a move government revenue has also widened.”

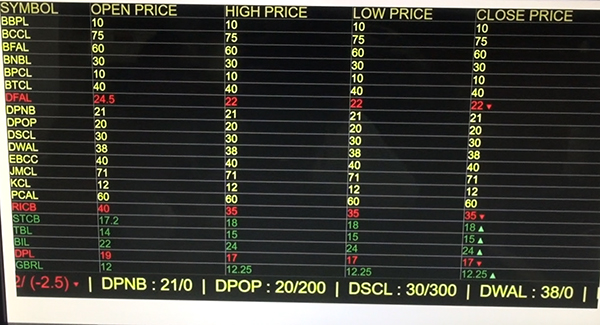

Bhutan’s stock exchange has been in existence for the last 22 years.

So far, there are 21 listed companies in the exchange.