If the Royal Monetary Authority’s quarterly payment system report is any indication, the demand for National QR or Quick Response code transactions is on the rise. This, according to the report, is influenced by factors such as ease of use, contactless transactions, and widespread acceptance at various stores.

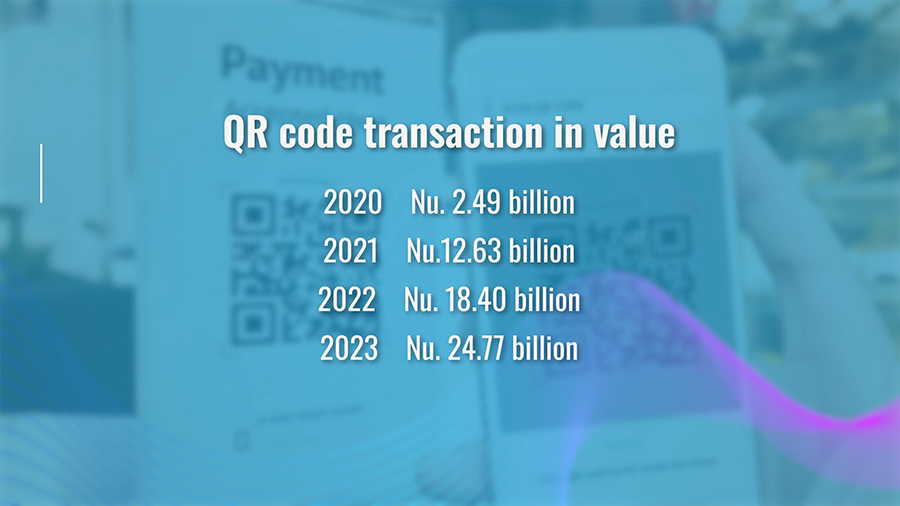

The data indicates an exponential growth of the use of QR code transactions both in terms of value and volume, in the last four years.

In terms of volume, from a little over two million in the fourth quarter of 2020, the QR code transactions increased to more than 27 million in the fourth quarter of 2023.

According to the report, transactions made using QR codes increased significantly in the fourth quarter of 2021. QR code payment increased from around Nu 2 M transactions worth close to Nu 2.5bn in the fourth quarter of 2020 to more than Nu 13 M worth over Nu 12bn during the same period in the following year.

The report highlights that there is continued growth in value which increased to almost Nu 25bn last year.

In terms of the number of businesses using the QR code, Thimphu recorded the highest registration of 601 in the fourth quarter of last year. This is followed by Samtse with 206 merchant registrations. Gasa and Dagana saw the least registration of merchants.

According to a payment toolkit study by the World Bank, the use of QR codes has increased during the COVID-19 pandemic as payments made via QR codes limit person-to-person contact and interaction and help comply with social-distancing norms adopted to prevent the spread of the virus during the pandemic.

Samten Dolkar

Edited by Phub Gyem