The National Council passed the Goods and Services Tax (Amendment) Bill and Customs Duty (Amendment) Bill today. The house also recommended the National Assembly to urgently introduce the amendment of the Public Finance (Amendment) Act 2012.

The National Council passed the Goods and Services Tax (Amendment) Bill and Customs Duty (Amendment) Bill today. The house also recommended the National Assembly to urgently introduce the amendment of the Public Finance (Amendment) Act 2012.

As per the Good Governance Committee of the house, there are two commencement dates for the GST Bill. The committee says this is against the Public Finance (Amendment) Act of Bhutan 2012. According to the committee, a money bill has to be implemented from the day it is tabled in the National Assembly.

Although the government is supposed to implement the GST Bill from next month, the finance minister while introducing the GST Bill in the National Assembly, proposed to defer the date for the implementation by a year. The minister reasoned that the Bhutan Integrated Taxation System (BITS), through which the government plans to digitize the GST system requires more time to be fully developed.

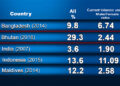

For the Customs Duty (Amendment) Bill, the Economic Affairs Committee rejected the flat 10 per cent customs duty on all items from third countries and recommended keeping the existing tax for few items. Last week, when the finance minister presented the Bill in the National Council, some members said reducing Customs Duty will increase the import of goods which might result in a huge outflow of foreign currencies. They also said that domestic firms and local industries would struggle to market their products having to compete with international products.

Both the bills will be sent to the National Assembly for final adoption.

Samten Dolkar