The government of India will provide Nu 4bn to Bhutan as trade support in the 12th Five year Plan. The prime minister said the fund would be utilized for making the country’s trading system more efficient.

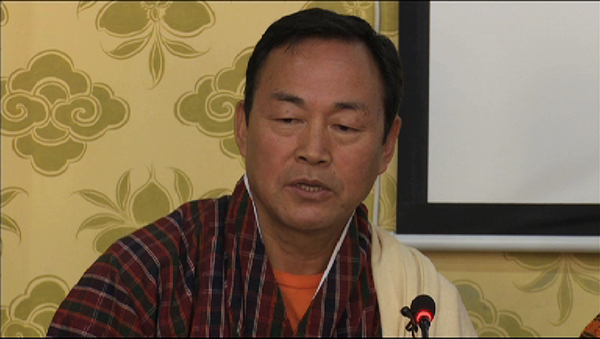

“The Indian government indicated very clearly that waving off of GST may not be possible. So, this money is for our government to prepare ourselves, to evaluate our products and to make them more competitive in the global market, in particular the Indian market,” Prime Minister Dr Lotay Tshering said.

The Indian government introduced Goods and Services (GST) in July 2017.

To minimise the impact of GST on Bhutanese exports, the government requested exemption of integrated GST on Bhutanese export in Indian market last year.

However, the Indian government said the exemption is not permissible under the GST law.

“Under the GST, you have this import tax credit system. The moment the Indian importers import Bhutanese products, it goes into the GST system and they will start getting tax credit. So, this has to be processed through the system. Therefore, if we break the chain in the GST import tax credit system, the producer in India will not get the actual benefit,” Finance Secretary Nim Dorji said.

“So, if they start exempting products from GST, there may not be any importers who would buy Bhutanese products because they will not benefit from the GST system.”

The trade support fund will also be used for strengthening bilateral trade and economic linkages between the two countries.