The government is unclear as to what extent of money injected in the banks in the form of economic stimulus fund has served the intended purpose of substituting imports, enhancing exports and creating jobs.

The government is unclear as to what extent of money injected in the banks in the form of economic stimulus fund has served the intended purpose of substituting imports, enhancing exports and creating jobs.

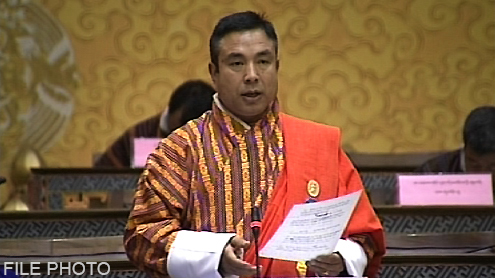

Finance minister, Namgay Dorji said results would not be known soon as businesses take time to set up. “But it has definitely helped the banks in terms of lending.” Whether it has created jobs, substituted imports or enhanced exports would be known later, added Lyonpo.

Around April last year, the government injected Rs 2.1B in the financial institutions as part of its reform to stimulate the economy under its Economic Stimulus Plan (ESP). Each bank received a pie of the sum depending on its capital fund.

The government had, last month, written to the banks asking whether the injection helped the banks and whether the money went into priority sectors.

Bankers said it was difficult to segregate and pin point where the money was used. It was complicated to find out whether the money went for job creation or for consumption, the bankers said.

The Chief Executive of Druk PNB, Mukesh Dave said the additional money made available through the ESP had made it more comfortable for the banks to finance projects and businesses without putting too much pressure on their capital base.

A banker said if it was to serve the objective of the ESP, the money should have been utilised in areas such as agriculture and manufacturing.

On the other hand, banks started financing an increasing number of cars after the government lifted the ban July last year. 4,000 cars were imported in seven months after the ban was lifted.

According to figures available with the central bank, growth of credit in agriculture and manufacturing remained more or less the same compared to 2014. In April 2014, credit to the manufacturing sector stood at Nu 10.1B. In March this year, it stood at Nu 9.3B.