Digital transaction through mobile and Internet banking has picked up significantly in the country during the time of the Coronavirus pandemic.

Digital transaction through mobile and Internet banking has picked up significantly in the country during the time of the Coronavirus pandemic.

As per the Central Bank’s quarterly payment system report, the number of transactions has increased by almost two million in the first quarter of 2020 compared to the fourth quarter of 2019.

The Central Bank says this happened on its own without much interventions from the financial institutions.

According to some of the business owners in the capital, the increase in the volume and value of digital transaction, could be an indication that some people are worried about contracting the virus through cash, as highlighted by international media houses.

In the past months, international media reported stories on how Chinese banks were disinfecting cash, due to fear of the virus spreading through cash, which changes hands multiple times a day.

Tshering Penjor, a shopkeeper in Thimphu, said that digital transaction has doubled in the wake of the pandemic. “Before COVID-19, most people pay in cash. But now because of the information going around which says that cash could spread the virus many are opting for mobile banking.”

Another shopkeeper, Dhurba Chhetri, said that they have been encouraging mobile banking among their customers since last year and around half of their transaction are digital. “ Now with the risk of virus transmission through cash, it has become even more important to encourage mobile banking,” he said.

he banking institutions in the country also waived mobile banking charges in an attempt to encourage digital banking during the pandemic.

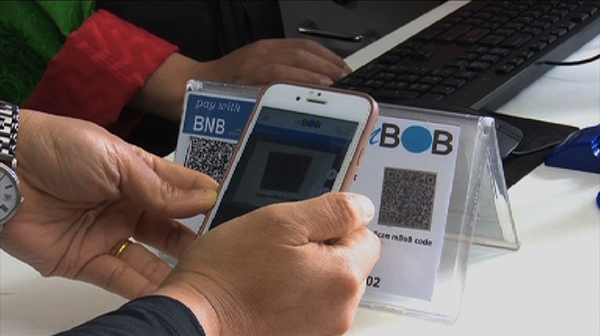

The Central Bank’s report also mentions that besides the coronavirus pandemic, promotion and deployment of QR codes at fuel depots, shopkeepers and vegetable markets has also made QR code and digital transaction popular among the public.

As per the Central Bank’s report, the amount transacted in the first quarter of 2020 accounts for more than Nu 27 billion as compared to over Nu 25 billion in the fourth quarter of 2019.

Phub Gyem