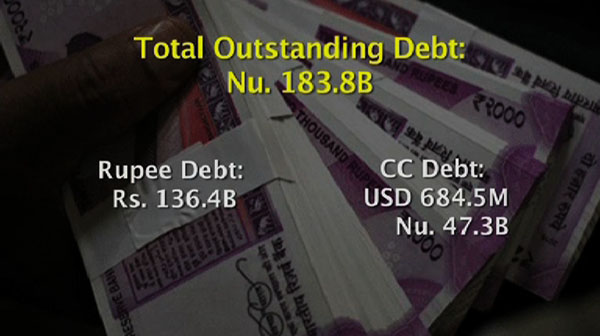

Bhutan’s outstanding external debt as of March, this year, stands at USD 2.65bn, which is about Nu 183bn, according to figures from the Royal Monitory Authority (RMA). Consequently, the debt to GDP ratio is 111 per cent, which is up by over five per cent from December, last year.

Bhutan’s outstanding external debt as of March, this year, stands at USD 2.65bn, which is about Nu 183bn, according to figures from the Royal Monitory Authority (RMA). Consequently, the debt to GDP ratio is 111 per cent, which is up by over five per cent from December, last year.

The debt to GDP ratio is the ratio of a country’s public debt to its gross domestic product (GDP). By comparing what a country owes with what it produces, the debt-to-GDP ratio indicates its ability to pay back its debts. Often expressed as a percentage, this ratio can also be interpreted as the number of years needed to pay back debt if GDP is dedicated entirely to debt repayment.

Of the total debt, Nu 136bn is rupee-denominated debt, while the convertible currency debt makes up USD 684 M, which is about Nu 47 bn. Convertible currency debt increased by over Nu 2bn in a year’s span, while rupee debt grew by almost Nu 10bn since March, last year against the country’s GDP, which stands at Nu 164bn as of March.

Loans from the World Bank and the Asian Development Bank alone constitute USD 528 M of the convertible currency debt. Hydropower has an outstanding loan of Rs. 122bn, of the total rupee debt of Rs. 136bn. In addition, the Government of India’s line of credit reflects another Rs. 7bn in debt.

Tala Hydropower Project has cleared off all its debt since the end of last year. The Punatshangchhu I has a pending loan of Rs. 46bn, Punatshangchhu II has Rs. 40bn and Mangdechhu with Rs. 34bn outstanding. The Nikachhu project also accumulated a loan of Rs. 1.5bn as of March this year.

A decade ago, the country’s total outstanding debt was just Nu 25bn, 56 per cent of the GDP, and of the total debt, 61 per cent was for hydropower. With the construction of multiple hydropower projects since then, this ratio has doubled today and still, more than 66 per cent of total debt is due to the hydropower projects.