Goods and Services Tax or GST on import of services from India to Bhutan are now exempted. This is as per the recent notification issued by the Central Board of Customs and Excise of India, upon Bhutan’s request to grant an exemption on import of services.

Goods and Services Tax or GST on import of services from India to Bhutan are now exempted. This is as per the recent notification issued by the Central Board of Customs and Excise of India, upon Bhutan’s request to grant an exemption on import of services.

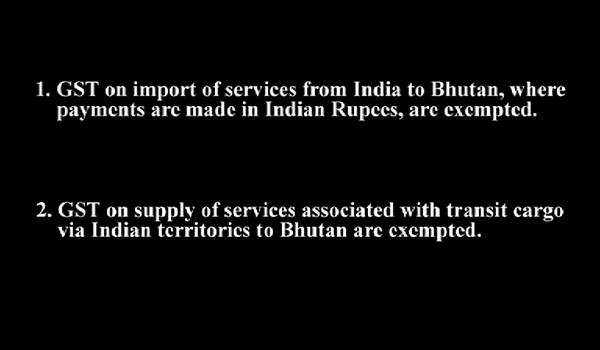

The notification reads: GST on import of services from India to Bhutan where payments are made in Indian Rupees is exempted and GST on supply of services associated with transit cargo via Indian territories to Bhutan is exempted.

Following the introduction of GST in India, private sectors which imported major services from India in areas of consultancy, transportations and auditing, engineering and technical expertise were affected. Thus, they requested the government to look into the matter.

“Finance Ministry along with Foreign Ministry requested the Indian government and we had several submissions that are related to this recent notification on India’s Central Board of Excise website,” said Sonam Penjor, Joint Commissioner of Department of Revenue and Customs.

He said the GST exemption is expected to benefit the Bhutanese economy and will help to curtail the outflow of Indian Rupee.

“Now based on this notification, our Bhutanese importers importing services from India will not be required to pay in convertible currencies,” asserted the Joint Commissioner.

Prior to the notification, the services consumed within the Indian territories are taxed.

Bhutan use various modes of transportation services such as rail road, trucks, and other sea ports in India to import goods and services into the country.