The Asian Development Outlook published recently reported that Bhutan’s economic growth is driven by public spending and capital accumulation. However, according to the report, capital accumulation mode of growth which refers to growth in wealth through investments or profits is unsustainable due to a decline in spending. The ADB recommended innovative financing approaches, such as implementing Public-Private Partnerships which have proven vital for leveraging private finance and bridging financing gaps effectively across many countries.

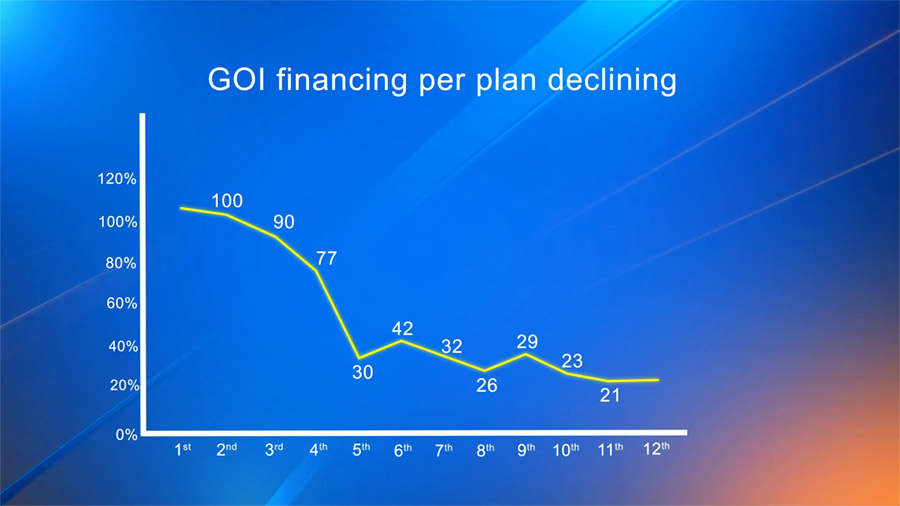

Besides being primarily dependent on public spending and capital accumulation, Bhutan’s economic growth experienced a decline in financing from other sources.

According to the ADB data, funding from the Indian government has decreased significantly, dropping from 100 per cent in the first Five Year Plan to 21 per cent in the 12th Five Year Plan.

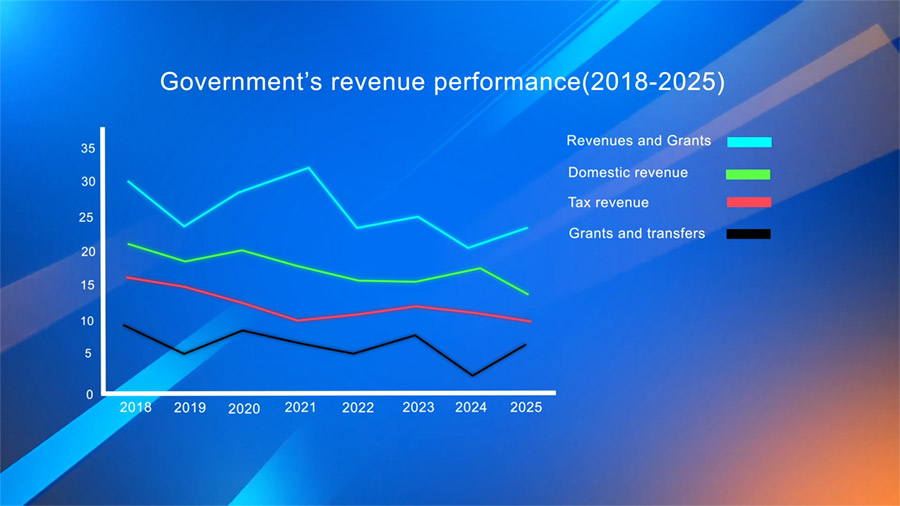

Additionally, the government’s revenue performance, including revenues and grants, domestic revenue, and tax revenues, which has generally remained stable also showed declines at times.

According to the ADB, these challenges need to be addressed if Bhutan is to achieve its goal of becoming a high-income economy in the next 10 years. The ADB says by leveraging the potential of Public-Private Partnerships (PPP) Bhutan can bridge the fiscal gap, generate employment, and foster partnerships between government and private sector.

The ADB also expressed its support to the government in terms of facilitating PPP initiatives.

“We have also offered government support in terms of capacity building for PPPs within MoF and relevant ministries. But we also stand ready to support the government if it wants to try out PPPs in health care diagnostic and solar power. Today, your whole health system is entirely government-driven and in the newspapers, you keep reading about long queues for basic tests. So perhaps health diagnostics and dental services if the governments want to go ahead, we stand ready to support the PPP,” said Shamit Chakravarti, Country Director, Bhutan Resident Mission, ADB.

However, according to the report, implementing PPP projects in Bhutan is not without its fair share of challenges. PPP implementation has been limited due to complex institutional settings, the absence of provision for unsolicited proposals, centralized approval procedures, a small market with a nascent private sector, dominant state-owned enterprises, limited awareness of PPPs, and a scarcity of successful examples.

Owing to these shortcomings, Bhutan’s only PPP, the multi-level car park in Thimphu, has not spurred further PPP development. A revised PPP policy awaiting Cabinet approval is expected to address the challenges.

The report highlights that achieving PPP success requires capacity building and knowledge sharing, creating a conducive business environment and reforming State-Owned Enterprises and their selective privatisation.

According to the report, globally the Public-Private Partnerships mobilised a total investment of USD 36.4bn across 44 countries in the first half of 2023. In the South Asia region, PPPs attracted USD 1.8bn, with India taking the lead in implementing PPP projects.

Samten Dolkar

Edited by Phub Gyem