Differences between bank and government land valuations mean rural landowners often get smaller loans when using land as collateral. Since they pay taxes based on government rates, many want banks to use the same valuation. Presenting its review report, the National Assembly’s Economic and Finance Committee stressed the need for consistent land valuation to make borrowing more transparent and accessible for the Bhutanese.

The Economic and Finance Committee said that the finance ministry’s PAVA valuations are used mainly for administrative purposes such as taxation and land compensation.

The Banks, however, provide land valuation based on credit risk assessment. They focus on how easily and quickly a land which is collateral can be sold without losing much value.

This difference in PAVA and bank valuation has often affected landowners in rural areas from getting loans equal to what they expect.

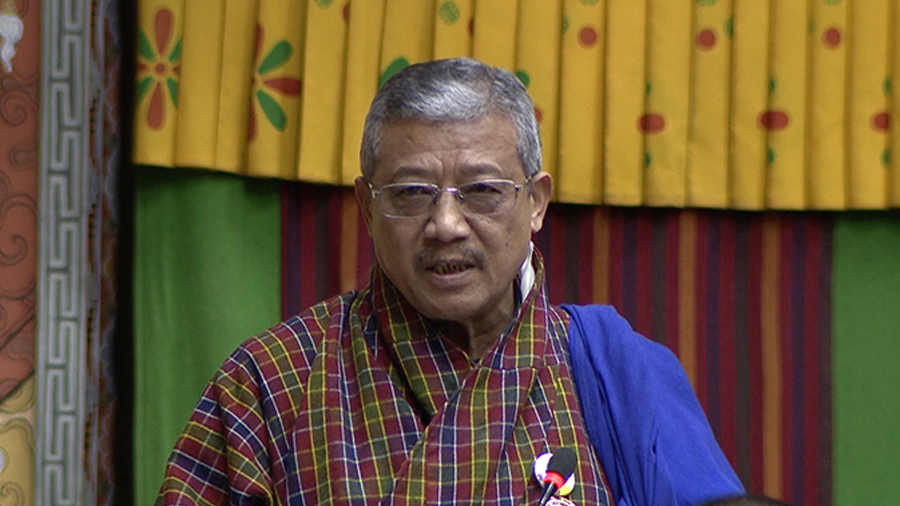

The member of the Economic and Finance Committee, Harka Singh Tamang said, “Due to weak land markets and high rates of unsold pledged collateral, BDBL continues to use a conservative 2017 valuation method. PAVA’s methodology, while detailed, is not designed for this risk-based lending context, creating a mismatch that restricts rural borrowing capacity.”

The Financial Institutions Association of Bhutan has introduced a Common Land Base Rate to harmonise land valuations, mainly for urban and semi-urban areas.

However, challenges persist in rural areas where land is harder to sell, prompting banks to assign lower values for lending.

The committee said standardised rates improve consistency, but banks must retain flexibility to assess lending risks accurately.

Additionally, the committee found differences in urban commercial loans and rural agricultural loans interest rates across banks. This has led to unfair and unclear lending decisions.

Harka Singh Tamang said, “While the Minimum Lending Rate provides a baseline, inherent risk differentials, for example, between urban commercial loans and rural agricultural loans, variations of interest rates will persist. Therefore, dispersion of credit is unjustified, not transparent, resulting in limited access to credit.”

Today, banks set interest rates based on operating costs, credit risks and their strategic focus on different borrowers.

Although the Royal Monetary Authority has revised the Minimum Lending Rate to improve consistency, the committee recommends improving transparency in communicating the rate decision by the banks.

KinzangLhadon/ KelzangChhophyel

Edited by Sangay Chezom