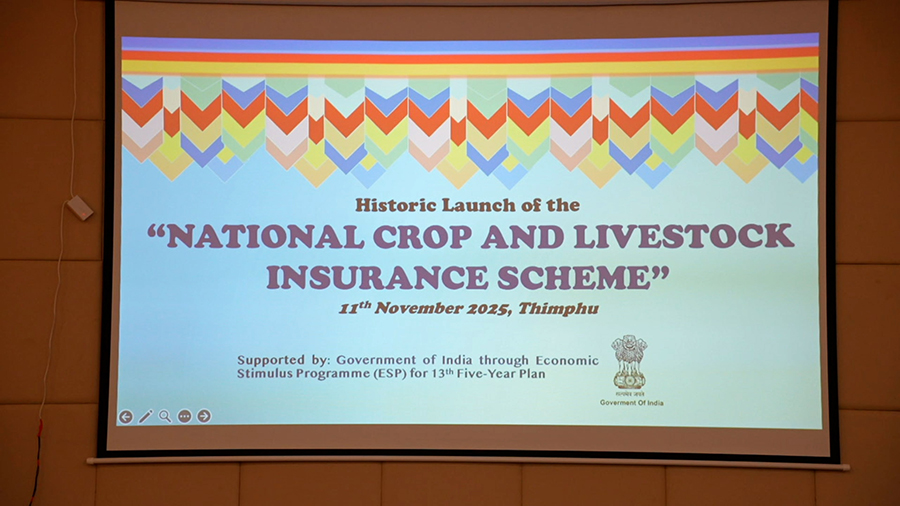

Farmers will now have an added layer of protection against natural disasters, pests, and wildlife damage. Coinciding with the 70th Birth Anniversary of His Majesty the Fourth Druk Gyalpo, the much awaited insurance scheme for the rural community was launched today in the capital. The National Crop and Livestock Insurance Scheme offers farmers financial security in times of crop failure and livestock loss.

Farmers will now have an added layer of protection against natural disasters, pests, and wildlife damage. Coinciding with the 70th Birth Anniversary of His Majesty the Fourth Druk Gyalpo, the much awaited insurance scheme for the rural community was launched today in the capital. The National Crop and Livestock Insurance Scheme offers farmers financial security in times of crop failure and livestock loss.

The National Crop and Livestock Insurance Scheme will cover four communities under agriculture and three livestock commodities.

Six pilot commodities farmers can insure include maize, potato, rice, orange, poultry, piggery and cattle.

Under the scheme, farmers will pay only half of the insurance premium, with the government subsidising the remaining 50 per cent.

Premium rates are set at 5.8 per cent for crops, 10 per cent for cattle, and 6 per cent for piggery and poultry.

The scheme is the government’s commitment to protect and empower farmers, who make up more than 41 per cent of Bhutan’s labour force.

The scheme is the government’s commitment to protect and empower farmers, who make up more than 41 per cent of Bhutan’s labour force.

Younten Phuntsho, Agriculture and Livestock Minister said, “Today’s launch of the National Crop and Livestock Insurance scheme is a small gesture of expressing our gratitude to His Majesty the Fourth King for his leadership in transforming the agriculture sector. The agriculture sector has a lot of challenges, a lot of natural disasters keep happening, so therefore this is a way of protecting farmers from these disasters.”

Six farmers from Trashi Yangtse have registered so far.

Tenzin Wangda from Trashi Yangtse said, “As a farmer, we need to raise cattle and we have a few jersey cows. Firstly, it is a good initiative by the government, hence we signed up for it. Secondly, this initiative is to boost and empower the lives of farmers who depend on livestock and agriculture for livelihood.”

During the launch, the ministry said that the commodities for these schemes will be expanded depending on the success of the pilot commodities.

As part of the launch, the Royal Insurance Corporation of Bhutan and the Bhutan Insurance Limited also signed a Memorandum of Understanding with the ministry, as the supporting partners for the scheme.

The Government of India, through the Economic Stimulus Programme, is providing 800 million ngultrum to support the government’s premium subsidy component of the scheme.

With this insurance initiative, the government aims to make farming more resilient, ensuring that not a single disaster destroy farmers’ livelihood.

Devika Pradhan

Edited by Phub Gyem