Many Bhutanese may not know that money from old investments is still waiting for them. More than Nu 87 M in unclaimed dividends and share proceeds are waiting to be collected by shareholders. The Royal Securities Exchange has now made it possible for people to check and claim this money through the new online system, launched yesterday.

Many Bhutanese may not know that money from old investments is still waiting for them. More than Nu 87 M in unclaimed dividends and share proceeds are waiting to be collected by shareholders. The Royal Securities Exchange has now made it possible for people to check and claim this money through the new online system, launched yesterday.

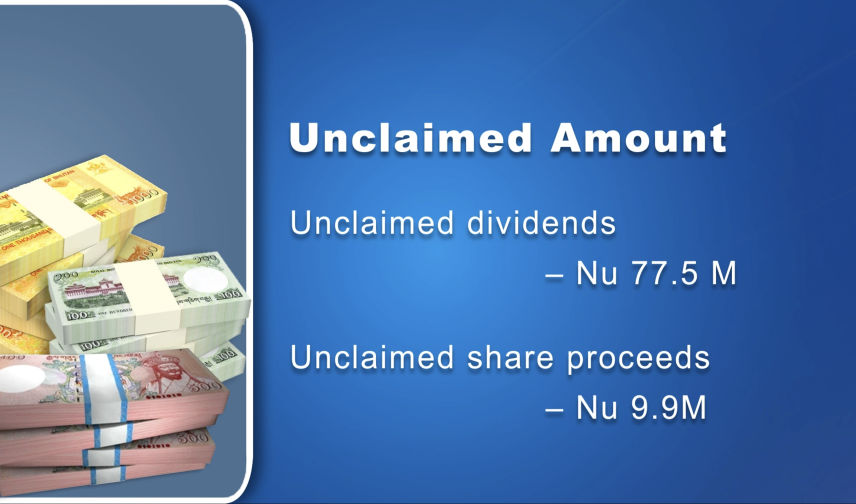

The unclaimed amount includes Nu 77.5 M in dividends from fourteen listed companies and Nu 9.9 M in share proceeds from five companies that are no longer listed in the stock market. Some have not claimed the money for the last 25 years.

When a company buys back old shares or delists from the stock market, shareholders are often paid for their shares. But if some fail to update their bank details or do not respond, the payment remains unclaimed. These unpaid amounts are referred to as unclaimed share proceeds.

Druk PNB holds the highest unclaimed dividends at Nu 40.1 M, while Bhutan Reinsurance Company has the lowest at just around Nu 0.12 M.

And all these amounts can now be claimed online through rsebl.org.bt/unclaimed.

“They need to visit our website and put their CID number. Once the CID is entered, they will get an OTP on their phone. Again, they need to put the OTP in the system. Once the OTP is entered, they will see if they have any unclaimed dividends. So, RSEBL in one to two days will transfer the amount to the rightful shareholder’s account,” said Dawa Dakpa, the head of policy division, RSEBL.

The initiative comes after the Investor Protection Fund Regulation 2024, which came into effect only this year. It requires all listed companies to transfer unclaimed dividends and unclaimed share proceeds to an account managed by the stock market after three months.

The stock market has already paid over Nu 2 M to around 400 shareholders. However, officials clarified this was not through the online system.

Dawa Dakpa said, “To minimise the issue of unclaimed dividends, RSEBL is conducting awareness programs on unclaimed dividends. Further, it is the responsibility of shareholders to keep their information updated with us. In the future, we also plan to collaborate with the National Digital Identity, which will enable shareholders to claim their dividends more easily.”

For most listed companies, shareholders can claim at any time. However, for financial institutions, unclaimed amounts will remain in the Investor Protection Fund account for ten years and then be transferred to the Central Bank.

With just a click away, shareholders now have an easy way to reclaim money. While the new system marks a significant step toward transparency and accessibility, it also serves as a reminder for investors to stay informed and keep their contact details updated.

Kinley Bidha

Edited by Tandin Phuntsho