Following widespread public debate over the government’s decision to levy a 10 per cent tax on interest earned from fixed deposits, the Finance Minister has come forward to clarify the rationale behind the move. The finance minister, in his Facebook post, said that nearly 13,000 people with fixed deposits earn about Nu 1.46bn in interest each year. A 10 per cent tax on this interest would generate around Nu 145 M in annual revenue for the country.

Following widespread public debate over the government’s decision to levy a 10 per cent tax on interest earned from fixed deposits, the Finance Minister has come forward to clarify the rationale behind the move. The finance minister, in his Facebook post, said that nearly 13,000 people with fixed deposits earn about Nu 1.46bn in interest each year. A 10 per cent tax on this interest would generate around Nu 145 M in annual revenue for the country.

Many citizens have taken to platforms like Facebook and TikTok, expressing confusion, frustration, and concern over the government’s proposal to levy a tax on interest generated from fixed deposits in the proposed Income Tax Bill 2025.

While some supported the proposal, many citizens expressed concerns over this decision, arguing it would discourage savings among those who have set aside money for their future.

In response, the finance minister has defended the decision, saying the proposed tax applies only to interest income, not the principal amount. The objective of the proposal is to ensure that all forms of income are treated fairly, without affecting saving or investment choices.

Moreover, the minister states that it will encourage high-income earners to contribute more to the economy.

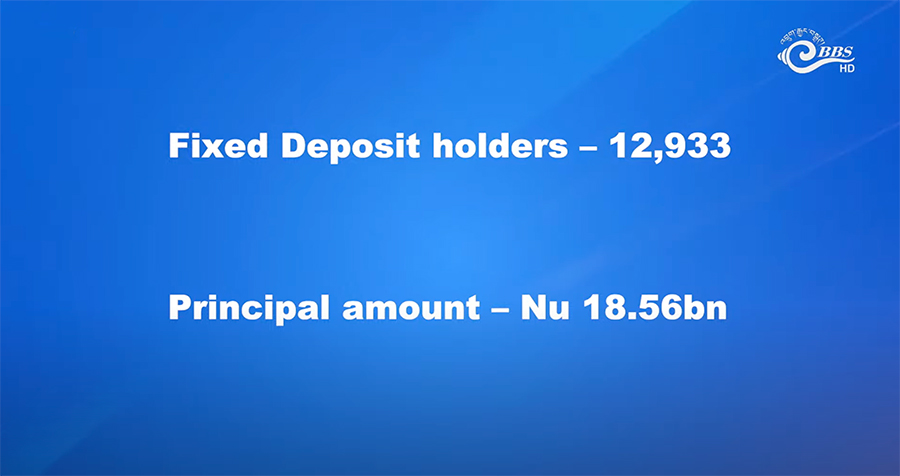

The finance minister wrote that there are nearly 13,000 fixed deposit holders with a principal amount of Nu 18.5bn. More than 380 people have Nu 10 M or more in fixed deposits.

Over 9,100 FD holders own Nu 100,000 to 1 M, and more than 3,000 FD holders own less than Nu 100,000 in fixed deposits.

The minister explained that most countries tax interest earned from bank deposits as part of regular income. Only a few places make exceptions.

He also wrote that it’s a small but necessary step toward a fairer tax system, one that reduces inequality and supports national self-reliance.

Samten Dolkar