Under the proposed Income Tax Bill 2025, individuals earning interest from fixed deposit accounts could face a 10 per cent tax, a measure, the government says, is aimed at ensuring fairness and simplifying tax compliance. The bill proposes that interest income, considered a form of passive income, be taxed through final withholding, meaning the bank will deduct the tax before crediting the interest to the depositor’s account. Taxpayers will not need to file additional tax returns on this income.

Under the proposed Income Tax Bill 2025, individuals earning interest from fixed deposit accounts could face a 10 per cent tax, a measure, the government says, is aimed at ensuring fairness and simplifying tax compliance. The bill proposes that interest income, considered a form of passive income, be taxed through final withholding, meaning the bank will deduct the tax before crediting the interest to the depositor’s account. Taxpayers will not need to file additional tax returns on this income.

To help you understand how this would work, here’s a simple example:

If you deposit Nu 100,000 in a fixed deposit at the Bank of Bhutan for three years, the interest rate is 7 per cent per annum. This means you will earn annual interest of Nu 7,000.

Under the proposed tax rule, the bank will deduct 10 per cent of this interest as Tax Deducted at Source or TDS, which comes to Nu 700. After tax deduction, you as a depositor will receive Nu 6,300 for the year.

While the tax rate is flat, the amount deducted will vary depending on the size of the fixed deposit. In short, the bigger the savings, the higher the tax.

The 10 per cent withholding tax on fixed deposits is also aligned to the same rate of tax on dividends.

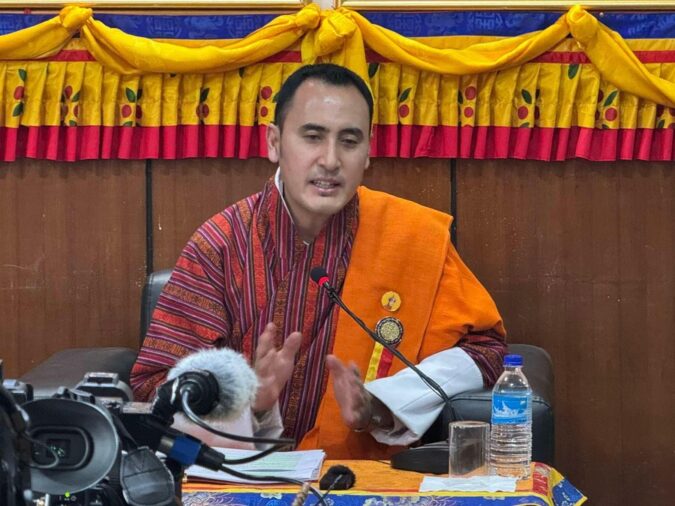

According to the government spokesperson, Industry, Commerce, and Employment Minister Namgyal Dorji, most people who earn interest from fixed deposits already have a high net worth.

By taxing the interest, the government hopes to reduce the gap between the rich and the poor and encourage people to invest their money in businesses or other economic activities instead of just keeping it in the bank.

The minister said, “Discussion on whether there should be a slab on fixed deposit amount to be taxed is also going on. Overall, this is just a recommendation from the government, and this matter will be deliberated in the parliament”.

The new measure is part of a broader package of tax reforms that also proposes a five per cent tax cut for salaried individuals and merging business income tax with personal income tax.

The new measure is part of a broader package of tax reforms that aims to cut taxes and put more money in the hands of individuals as well as businesses. This is to spur the country’s economic growth.

The new proposal aims to merge business income tax with personal income tax, simplifying taxation for small businesses.

For individuals PIT filers, while the taxable tax slab has remained at Nu 300,000, the proposed benefit is also anticipated to be higher. The starting tax slab has been reduced from 10 per cent to 5 per cent.

There are a number of tax-deductible expenses and rebates that have been introduced, which means now only people earning around Nu.500,000 or more will have to pay taxes, instead of the current rule where anyone earning Nu.300,000 or more is taxed.”

The bill has been introduced in the Parliament, and discussions are expected to take place in the coming days.

Samten Dolkar

Edited by Phub Gyem