Since it began making payments to civil servants from July the electronic public expenditure management system (e-PEMS) is facing technical issues in deduction of loans and remittances of the civil servants.

Since it began making payments to civil servants from July the electronic public expenditure management system (e-PEMS) is facing technical issues in deduction of loans and remittances of the civil servants.

From July till yesterday, the system met failed transactions relating to loan deductions amounting to Nu 10 M. This amount is currently held at a temporary account with the Bank of Bhutan Limited. Accounts officials are currently working on the issues.

These accounts officials from various agencies came to the department of public accounts’ office to solve the issues they are facing with regard to payment and loan deduction of civil servants.

These accounts officials from various agencies came to the department of public accounts’ office to solve the issues they are facing with regard to payment and loan deduction of civil servants.

The department said there are instances where accounts officials’ typing errors resulted in a payment of more than the actual salary a civil servant is actually entitled to. There are also reported cases of disbursing payments without deducting loan payments.

“Although our e-PEMS was successful, loan deductions of civil servants are still lying in the bank because of issues related to validation of bank accounts details especially loan accounts. For this we have also looked at what are some of the reasons for rejections- the majority are invalid account number, wrong account number, mismatch of account number; some provided loan account number, some provided a savings account number,” said Tshering Dorji, the Director for Department of Public Accounts, Ministry of Finance.

He also said e-PEMS is primarily developed to make payments and not designed to manage deductions. He said managing deductions through the e-PEMS would lead to delays in loan remittances which could further lead to penalties and charges. Also, the department says too many deductions could pose risk to the system performance. Hence the department is proposing civil servants to go for other alternatives to manage their deductions.

“To ensure that our loan deductions are made timely, we are also proposing to have an option to encourage our employees to use mobile banking apps to make such payments. From August we are planning to link all these deductions to their individual savings accounts. From e-PEMS, the salary will be disbursed to their savings accounts and from the savings account, it will be linked to individual deductions. That will greatly help us to improve service delivery,” he added.

The e-PEMS made over 12,000 transactions worth Nu 2.7 bn from July till yesterday. The transactions include payments made to civil servants, suppliers, vendors, contractors and other payments.

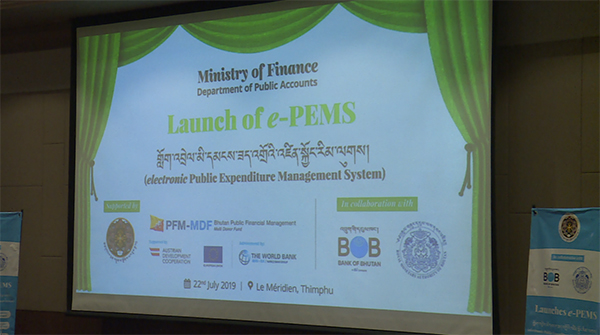

Finance Ministry and Royal Monetary Authority launched e-PEMS last month to enhance public finance management and promote cashless payments.